BRS Mid Year Equity Strategy 2025 - Full Potential Yet to Unfold, Equities Hold the Edge

Loading...

Strategy Reports

07/07/2025

878

0

📢 Full Potential Yet to Unfold – Equities Hold the Edge

🧭 BRS Mid-Year Strategy | 2025

We remain Overweight Equities as 🔑 fundamentals, liquidity & valuations align to fuel the next leg of the market re-rating.

🧭 Key Drivers:

🔒 IMF Discipline & Political Stability – Credibility restored, risk premium easing

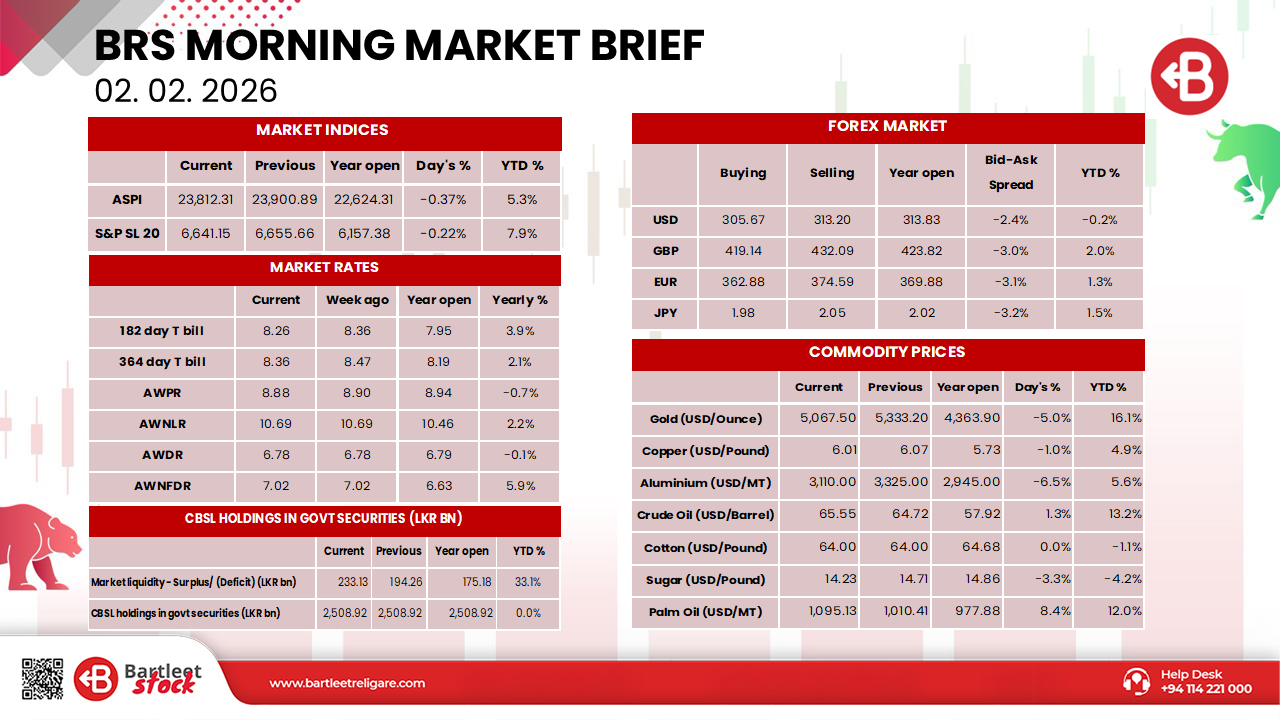

💸 Low-Yield, Tax-Efficient Environment – Equities > AWFDR (5.9% post-tax vs. 9.3% pre-tax)

📊 Liquidity Rotation – LKR 4.1bn avg. daily turnover in 2025 YTD (+70% vs. 5Y avg)

📈 Earnings Growth – LKR 672bn ➡️ 762bn from 2025E to 2026E

📉 Valuations Still Attractive – 2025E PE at 9.6x vs. 10Y avg. of 11.1x → 15% upside to ASPI 20,750

📍 Technicals Confirm Trend – EMA crossover, MACD strength, RSI in bullish territory

💰 Top Buys:

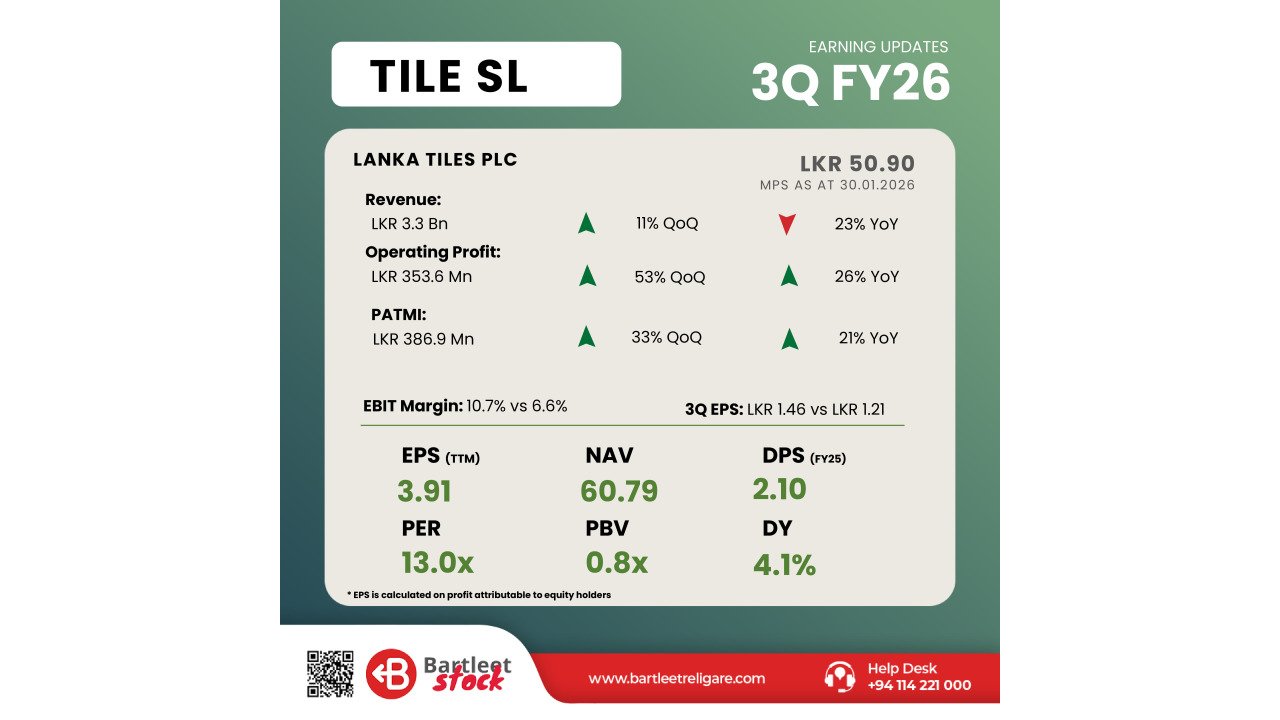

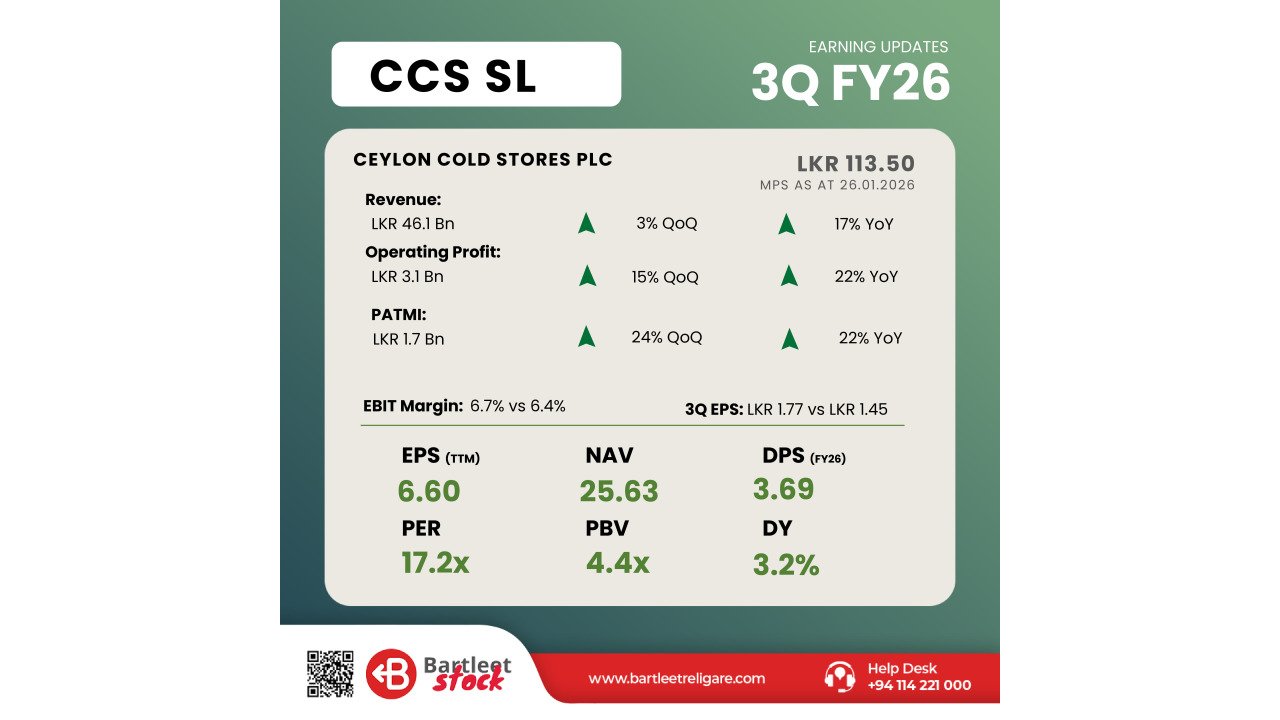

COMB (N & X) | HNB (N & X) | SAMP | COCR | LFIN | JKH | HHL | CCS | CIC (N & X) | DIST | CTC | HAYC | TJL | PACK

🟡 Hold (Moderate Upside <15%):

SUN | LLUB | GLAS

⚠️ Risks: IMF reform slippage, US tariff shocks, geopolitics, capital outflows

📊 ASPI fair value: 20,750 | Momentum intact ✅

You must login to post a comment.