GLAS 2Q FY26 Earnings Review

Earnings Reviews

10/12/2025

302

0

⚖ Short-Term Pressure, With a Possible Long-Term Turnaround

💰 EPS of LKR 1.05 for 2Q FY26, backed by a PAT of LKR 995.9mn (+18.3% YoY).

🏭 Furnace refurbishment shifted to 4Q FY26 (starting 1 Jan 2026, ~60 days). GLAS is building inventory ahead of downtime while planning higher imports from PGP India to meet both local and export demand, leading to higher trading volumes and mild margin dilution.

📦 Capacity constraints guide product mix: GLAS is prioritizing high-margin export lines and strong local demand, especially from the liquor segment. *Local volumes rose 12% YoY, while export contribution to revenue dipped to 30% (from 35% last year) due to production limits.

🧪 Cost relief from raw materials: Soda ash prices remain subdued, while Saudi Aramco’s LPG benchmarks are trading below last year’s levels, offering a buffer against near-term production headwinds and help sustain margin stability.

📉 Near-term outlook: Earnings expected to weaken in 4Q FY26–early FY27 due to lower production and higher reliance on trading. However, performance should normalize post-refurbishment as operations stabilize.

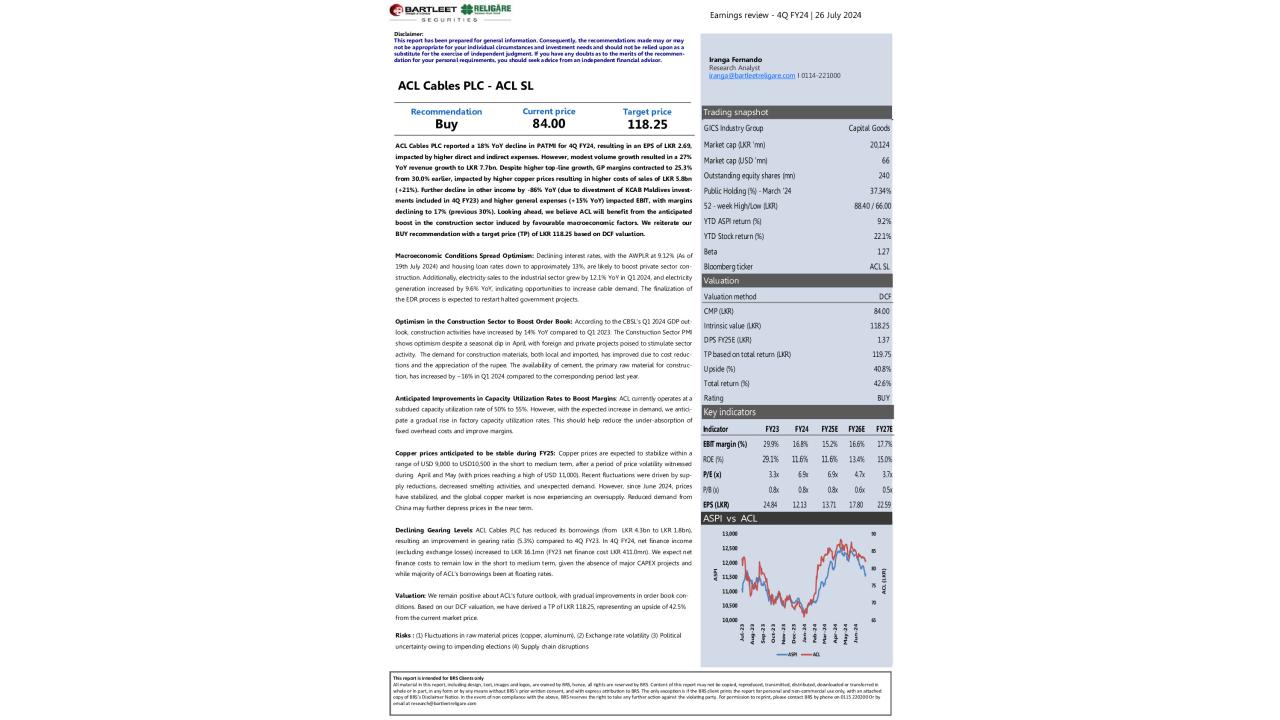

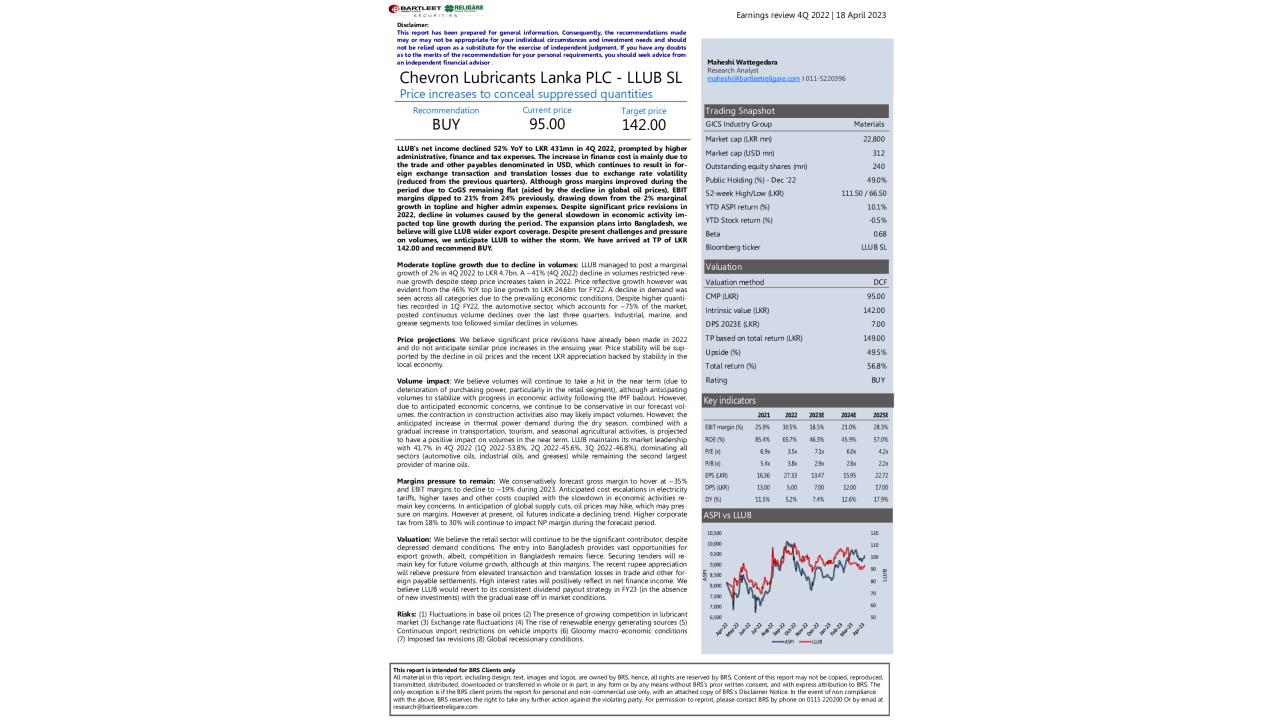

📈 Valuation & recommendation: GLAS trades at 10.7x forward PER (based on FY27E EPS of LKR 5.11). Our FY27E target price of LKR 57.80 indicates an upside of ~6%.

Recommendation: HOLD

You must login to post a comment.