Hemas Holdings PLC (HHL) - 1Q FY25_ BUY

Earnings Reviews

18/09/2024

233

0

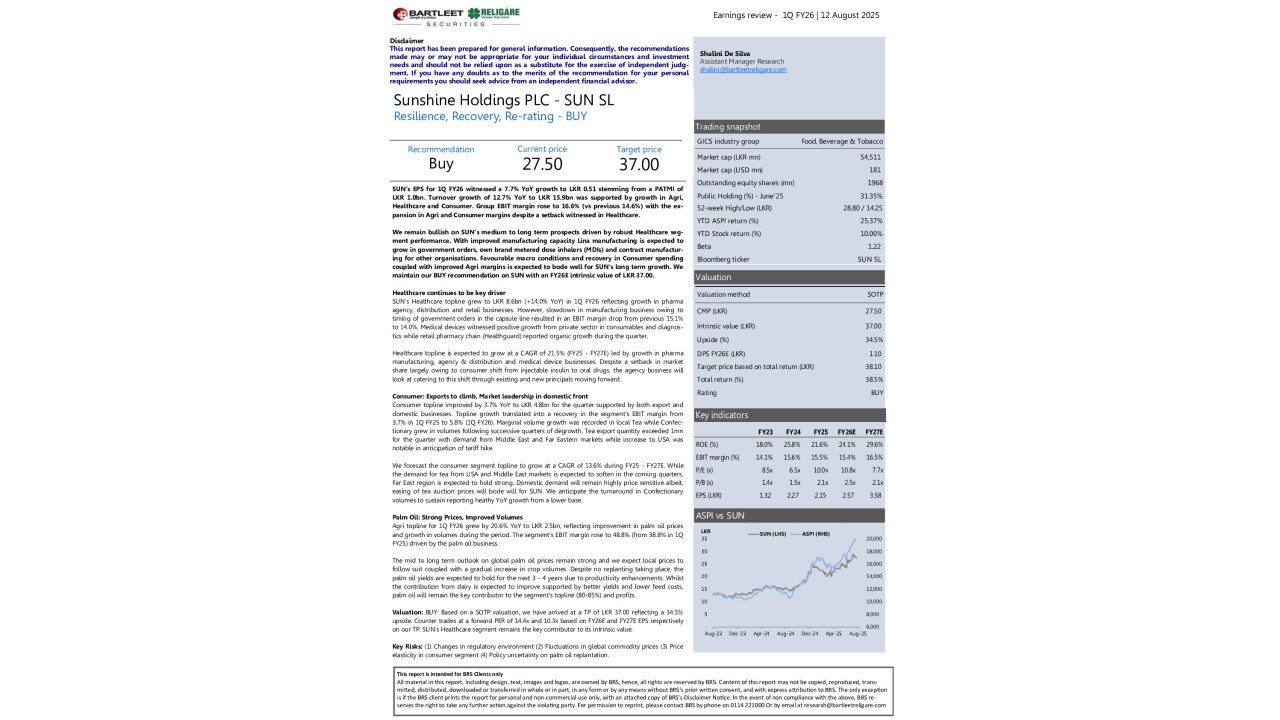

Despite short-term setbacks we believe volumes in the Home & Personal Care (HPC) segment

will bounce back in the 2H FY25E with improved consumer spending and additions to the product portfolio. Atlas, the market leader in mass market and Value for Money (VFM) stationary products will continue as a strong contributor to the consumer segment’s margins. The widening branded generic portfolio, opportunities in contract manufacturing along with a focus on a niche product mix is expected to drive returns from the Healthcare segment. We continue to

maintain our BUY recommendation, having arrived at an intrinsic value of LKR 107.00 on SOTP valuation.

You must login to post a comment.