Rebuilding Sri Lanka: The 2026E Selective Equity Opportunity

Strategy Reports

31/12/2025

880

0

🎯 Strategy – Selective Overweight

We favor selective overweight exposure to reconstruction and consumptionlinked sectors. While near term upside is modest, medium term returns remain intact as earnings and valuations normalise.

🌪️ From Shock to Recovery

Cyclone Ditwah is expected to pressure earnings through 1H 2026E. A multilateral backed reconstruction phase should begin support activity from 2H 2026E, driving a sector led recovery through 2027E.

⚖️ Supportive Backdrop

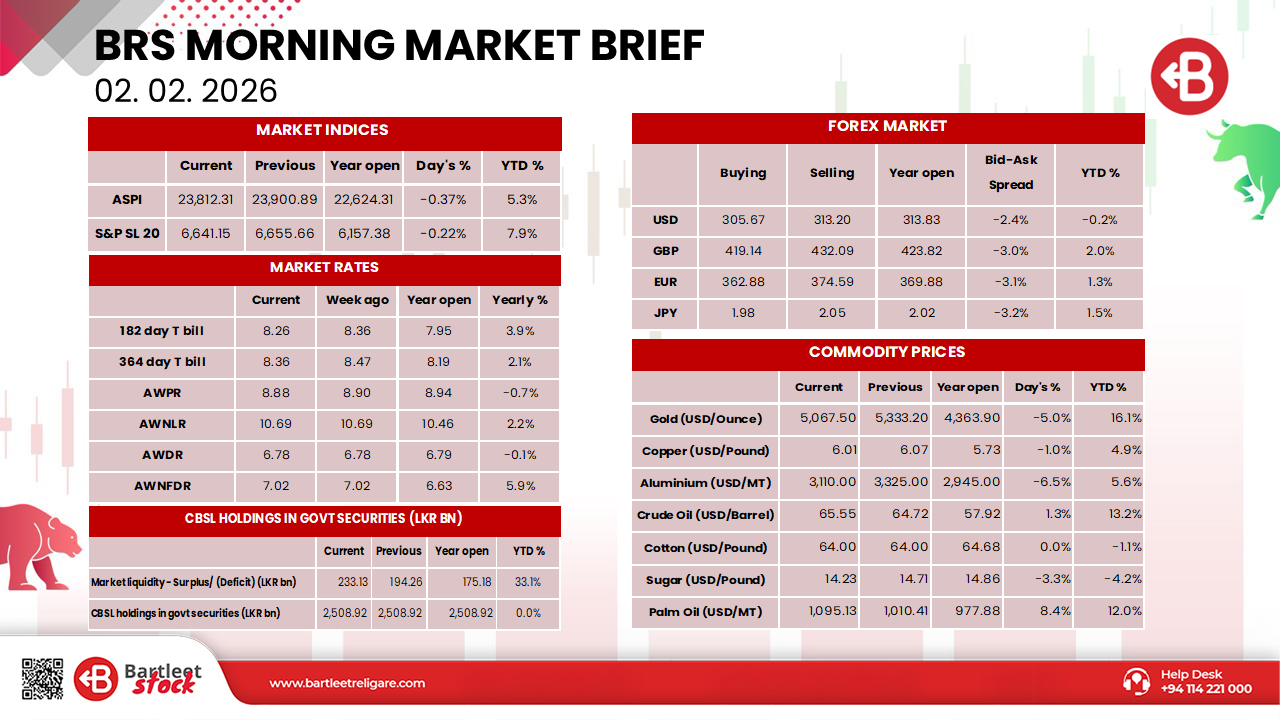

Stable interest rates, tax-exempt capital gains, and sustainable liquidity continue to support equities.

📊 Earnings & Valuation

• Earnings: +10% in 2026E (LKR 765bn), +14% in 2027E (LKR 872bn)

• ASPI targets: 23,500 (2026E) | 27,000 (2027E)

🧭 BRS Recommended Portfolio

🏗️ Construction & Related: AEL, ACL, SIRA, CIND, TKYO

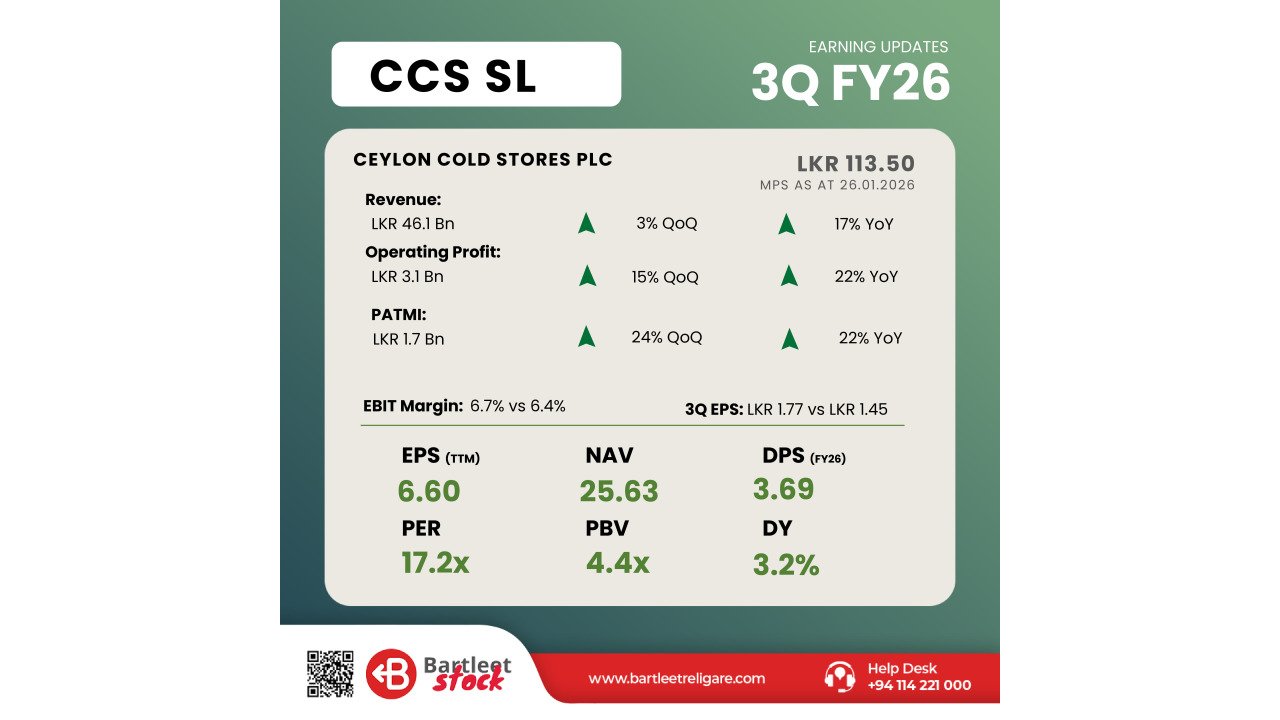

🛒 Consumption: HHL, CIC, DIST

🏦 Financials: COMB, HNB(X), COCR

🏭 HAYC | 🚕 PKME | 💰 LLUB

⚠️ Risks: Fiscal slippages | Funding gaps | Inflation | Monetary tightening

You must login to post a comment.