ACL Earnings Review 2Q FY26 - BUY

Earnings Reviews

30/12/2025

1.3k

0

ACL Earnings Review 2Q FY26 / Bartleet Religare Securities – 30.12.2025

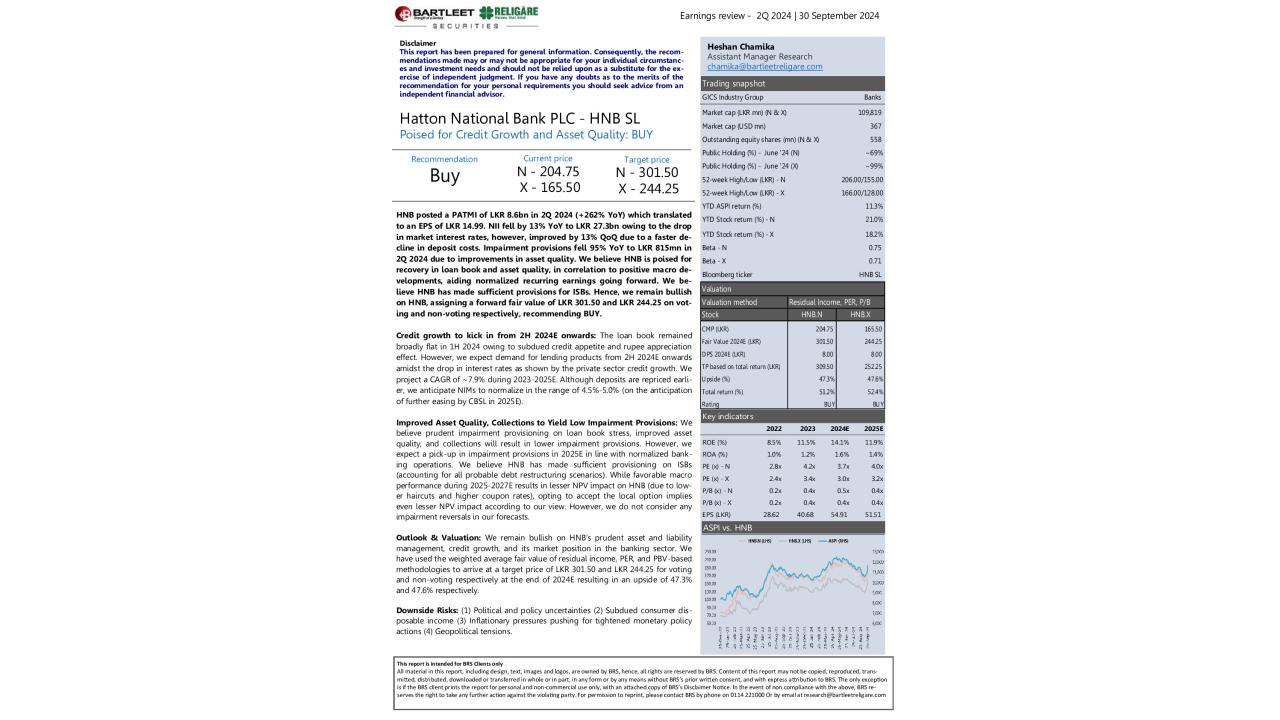

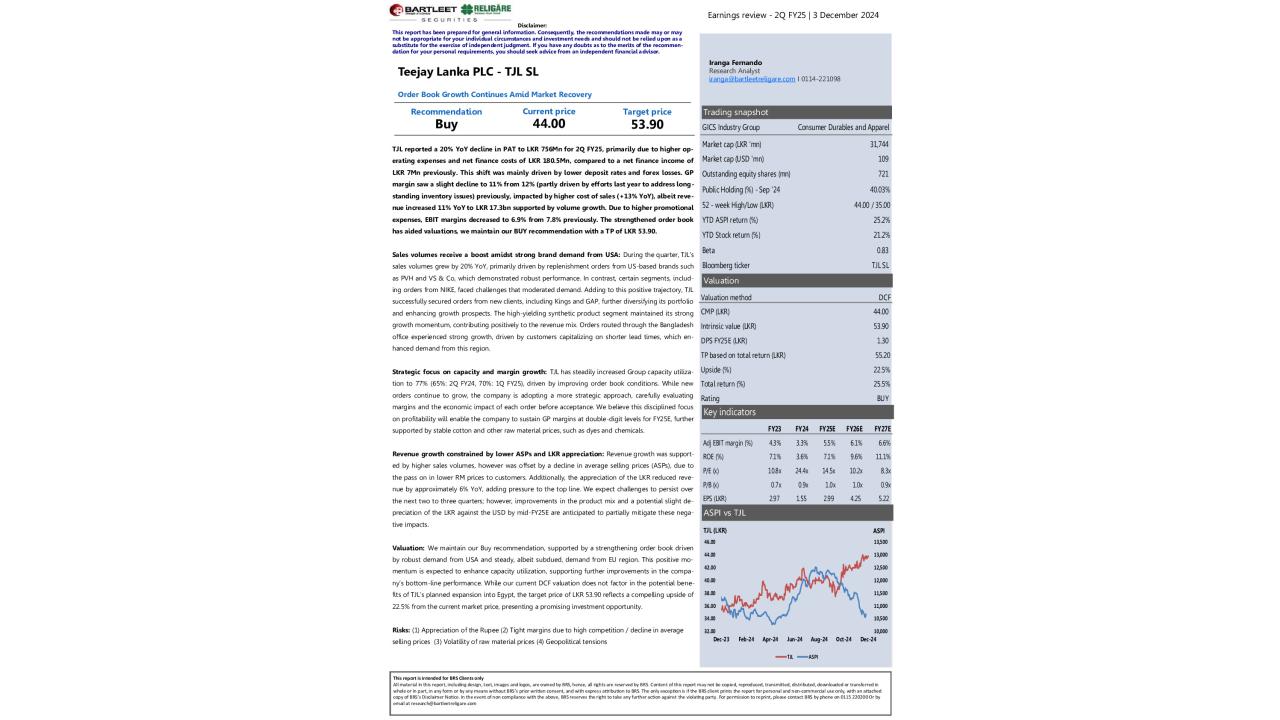

⚖ Earnings Set to Surge on Volume Growth Fuel by Expanding Order Book

💰 EPS of LKR 6.19 (pre-subdivision) for 2Q FY26, with PATMI reaching LKR 1.5bn (+38.8% YoY), driven by sales growth of 19.9% YoY and 15.0% QoQ.

🏗 Local sales led the revenue growth : Local sales increased 24% YoY to LKR 9.1bn, while export sales grew 7% YoY to LKR 2.3bn. Growth was primarily volume-driven, with institutional demand from CEB contributing significantly to topline momentum.

📦 Capacity well-positioned to capture demand growth: Utilization stood at 60% in 2Q FY26 and is expected to rise to 71–74% over FY27–FY28. ACL is well-positioned to capture post-Cyclone Ditwah reconstruction demand, supported by its dealer network, institutional projects, and rising government capital expenditure, enabling accelerated revenue growth in the near term.

🪙 Price adjustments expected amid cost pressures: Sustained high copper prices (USD 12,200+/MT) and a depreciating LKR point to near-term price revisions, supporting revenue growth while mitigating margin pressures.

📈 Valuation & recommendation : A blended DCF and PER approach yields a FY27E target price of LKR 154.00 (+84.4% upside). With a forward PER of 5.5x, the market has yet to fully reflect ACL’s growth potential.

Recommendation: BUY

You must login to post a comment.