Teejay Lanka PLC (TJL) - 2Q FY25 - BUY

Earnings Reviews

03/12/2024

375

0

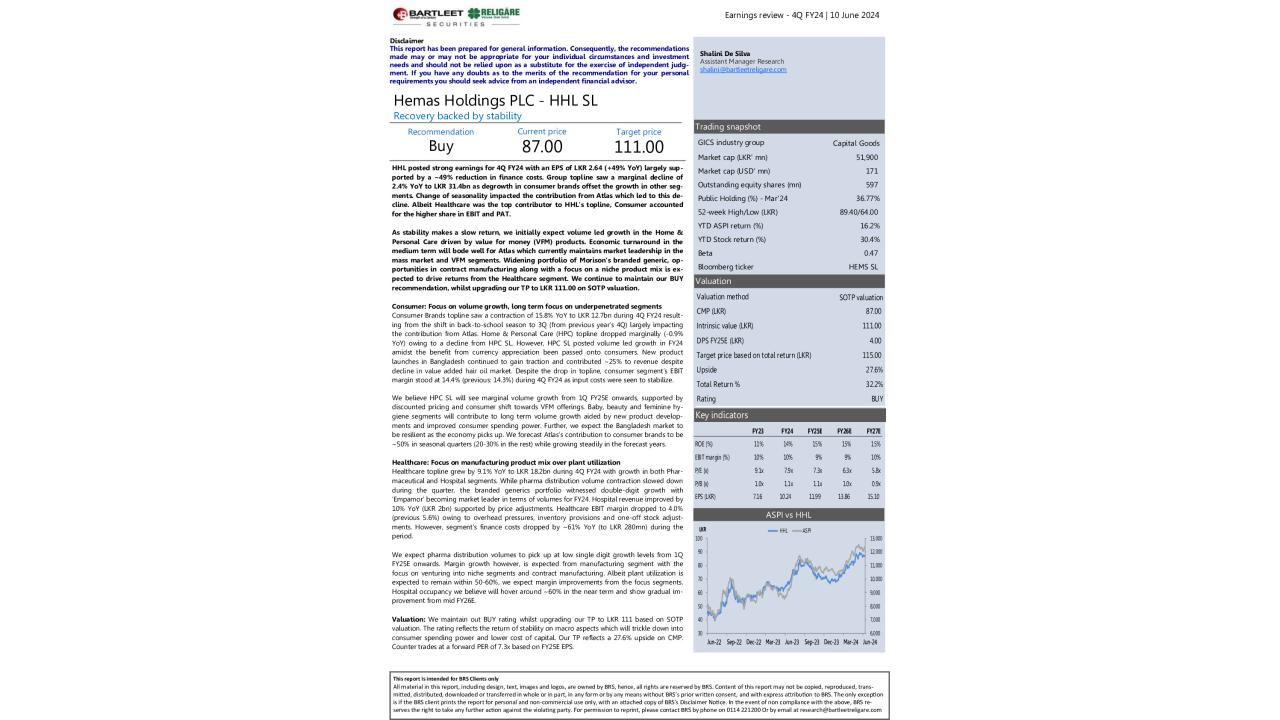

TJL reported a 20% YoY decline in PAT to LKR 756Mn for 2Q FY25, primarily due to higher operating

expenses and net finance costs of LKR 180.5Mn, compared to a net finance income of

LKR 7Mn previously. This shift was mainly driven by lower deposit rates and forex losses. GP

margin saw a slight decline to 11% from 12% (partly driven by efforts last year to address longstanding

inventory issues) previously, impacted by higher cost of sales (+13% YoY), albeit revenue

increased 11% YoY to LKR 17.3bn supported by volume growth. Due to higher promotional

expenses, EBIT margins decreased to 6.9% from 7.8% previously. The strengthened order book

has aided valuations, we maintain our BUY recommendation with a TP of LKR 53.90.

You must login to post a comment.