Beyond Valuation Gap, Unlocking Growth in NBFI Sector - Sector Initiation Report - BRS Equity Research

Sector Reports

03/04/2025

799

0

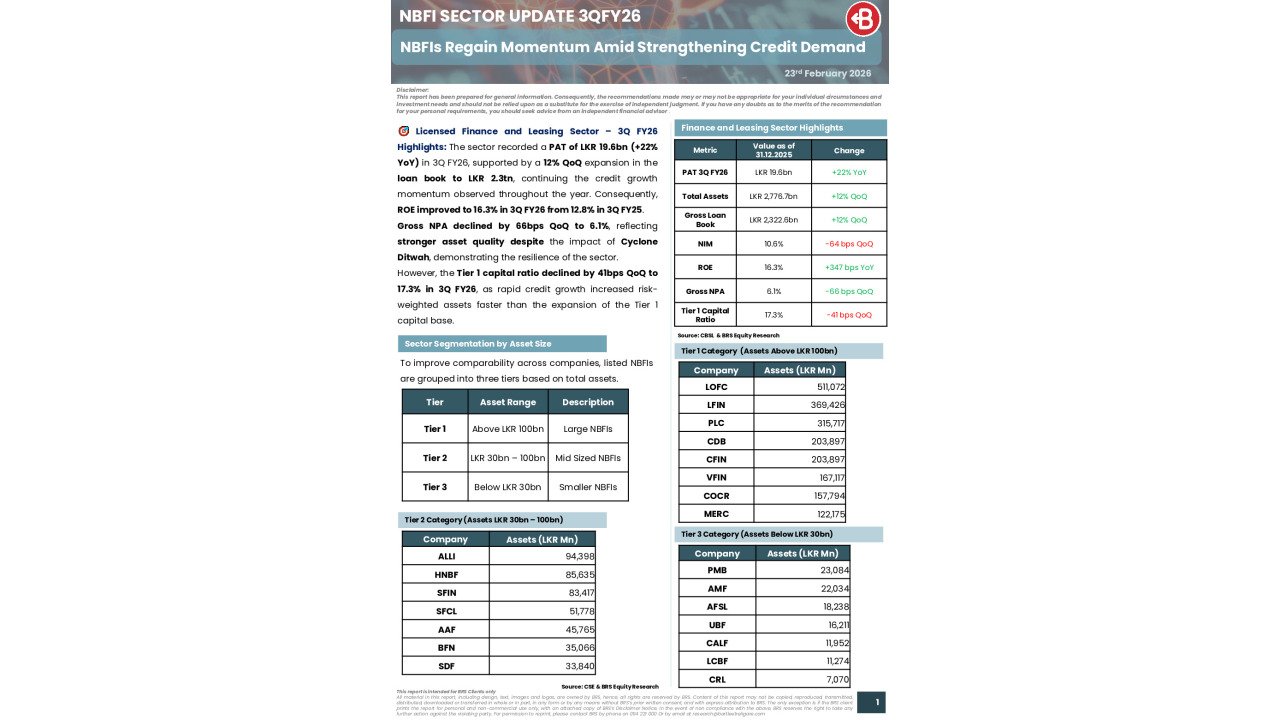

We believe the listed NBFI sector is poised for a rerating driven by:

🚀 Robust Net Interest Margins (NIMs) – supported by stable lending yields and funding structure

🚗 Vehicle import relaxations expected to reignite the leasing engine

🏪 Low penetration into the SME segment creates room for microfinance expansion

💰 Surging gold prices offer a near-term tailwind for the pawning segment

📈 Improving asset quality, underpinned by macroeconomic tailwinds

🔁 With an SME-led recovery, we anticipate rising credit demand across micro, leasing, and trade-related financing.

📊 Our BRS NBFI Investment Universe (LOFC, LFIN, PLC, CDB, VFIN, COCR, CFIN, ALLI) captures ~70% of industry loans and assets, providing a strong proxy for the sector.

💸 The Diversified Financials sector trades at 0.9x PBV, well below the 10 year CSE average (1.1x) and regional average (1.8x), signaling deep value potential.

✅ BUY: COCR, ALLI, CDB (N & X), VFIN, LFIN, CFIN

⏸ HOLD: LOFC, PLC - upside already priced in

⚠️ Key Risks: Delayed economic recovery, weak leasing demand, bank competition, gold/vehicle price volatility, and monetary tightening

You must login to post a comment.