COMB 3Q 2025 Earnings Review - BRS Equity Research

Earnings Reviews

26/11/2025

775

0

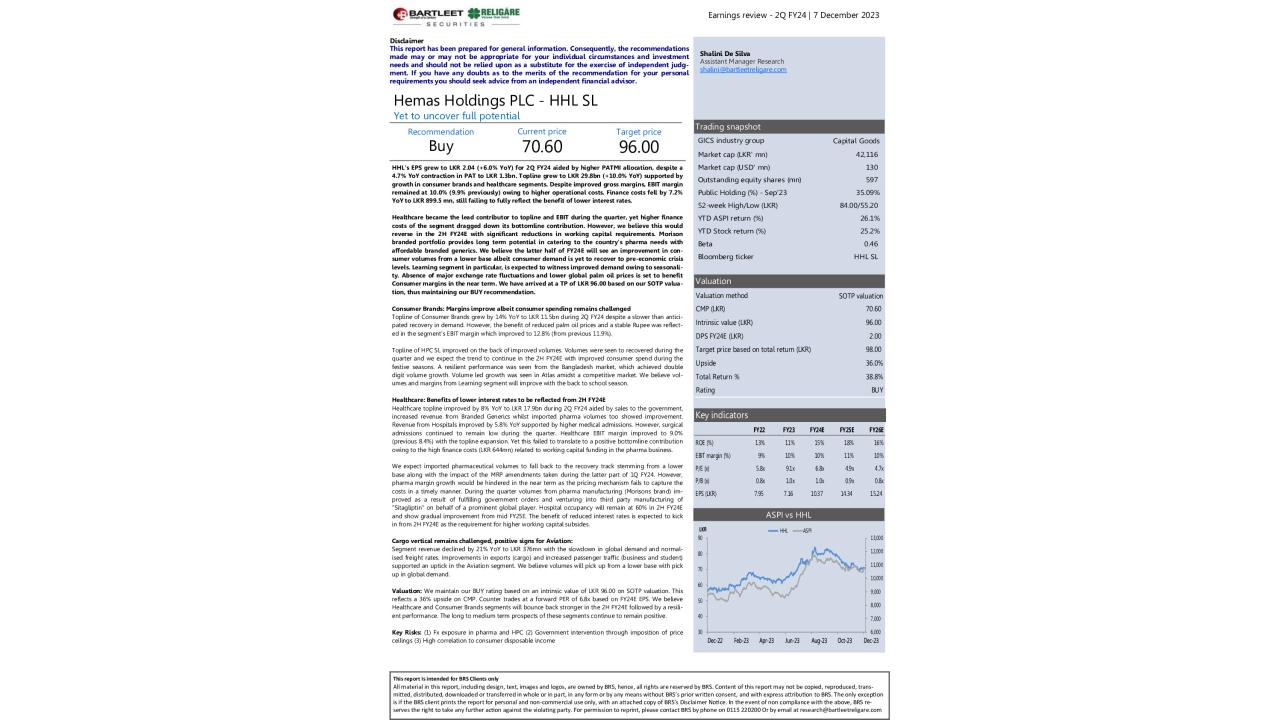

📈 Growth Momentum and Quality Delivering Superior ROEs

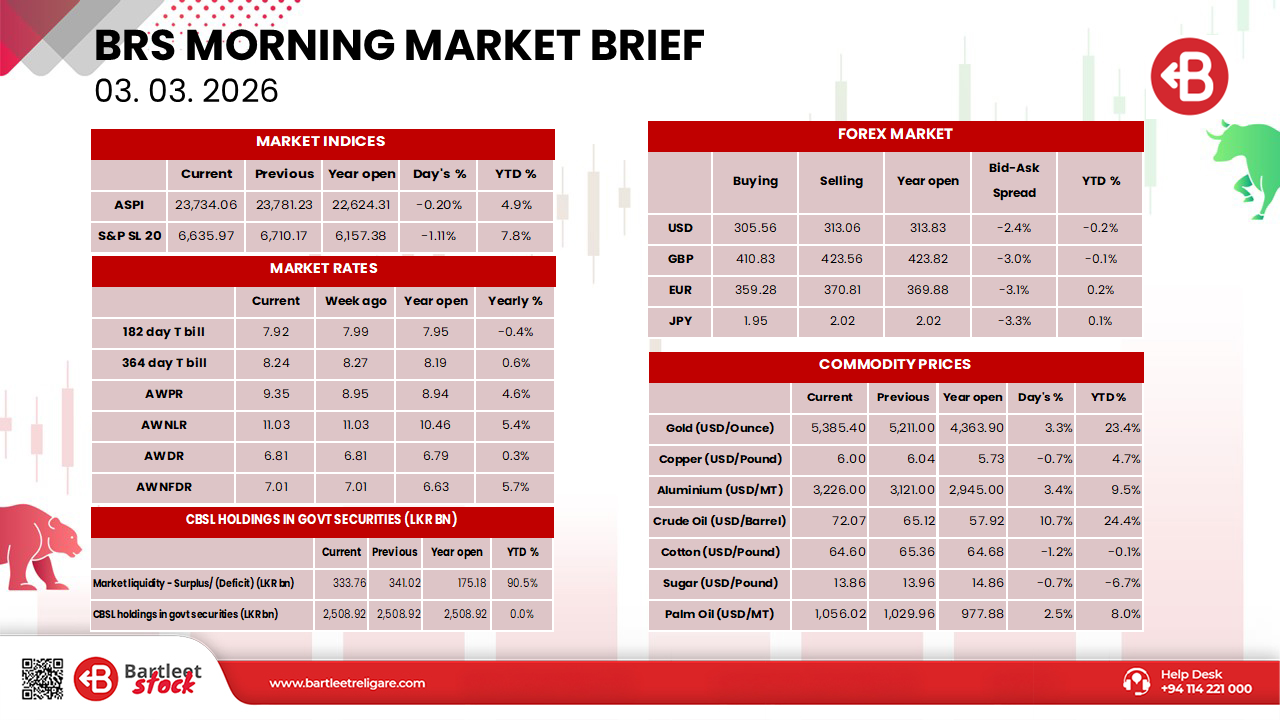

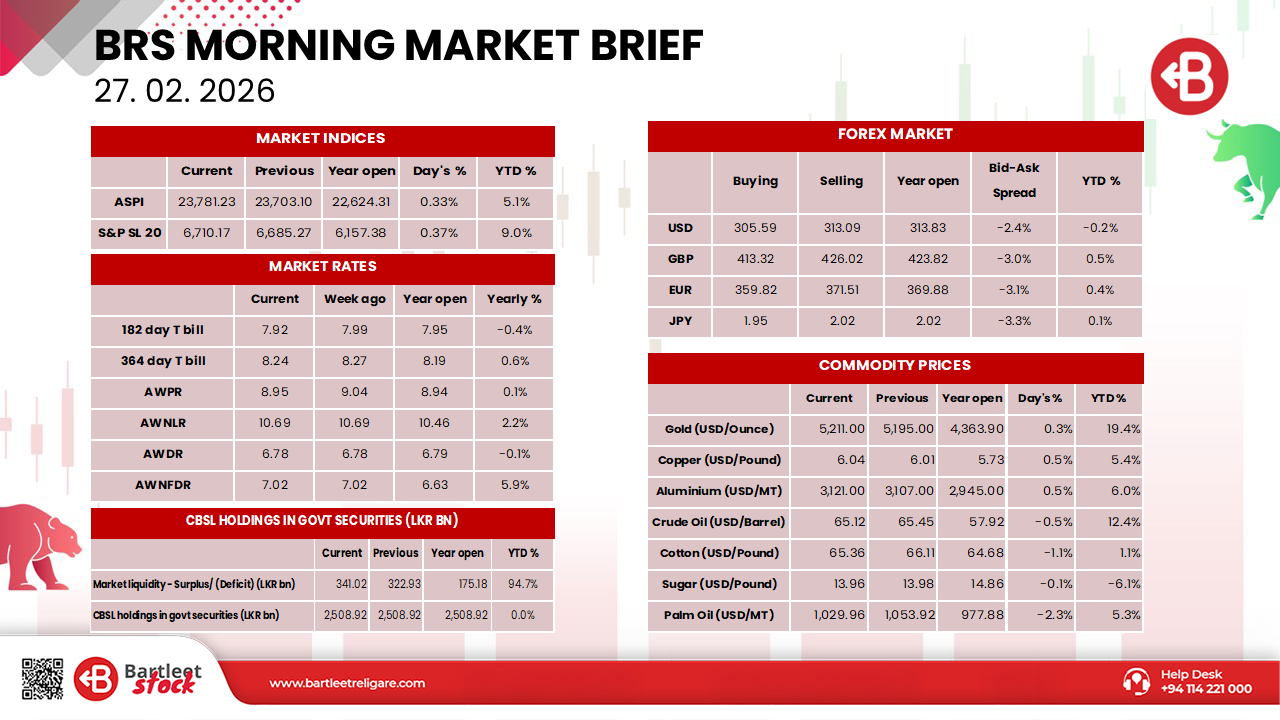

💰 Solid earnings delivery: PATMI of LKR 16.6bn in 3Q 2025 (+33% YoY) and EPS of LKR 10.18, driven by strong NII growth (+14% YoY) and robust loan book expansion.

📘 Credit growth upgraded: 2025E loan growth lifted to 31% (from 20%) on stronger local demand and COMB’s market share gains.

📊 Margins resilient: NIM stood at 4.5% in 3Q 2025, with margins expected to normalize around ~4.2% over the medium term.

🛡 Asset quality strengthening: Stage 3 ratio improved to 1.8%, while provision coverage increased to 71.4%, supporting balance sheet resilience.

📈 Valuation & recommendation: Target prices revised to LKR 260 (COMB.N – BUY) and LKR 217 (COMB.X – HOLD) for end-2026E, with ROEs forecast around ~18%.

⚠ Risks: Credit slowdown, policy uncertainty, early monetary tightening, geopolitical tensions.

You must login to post a comment.