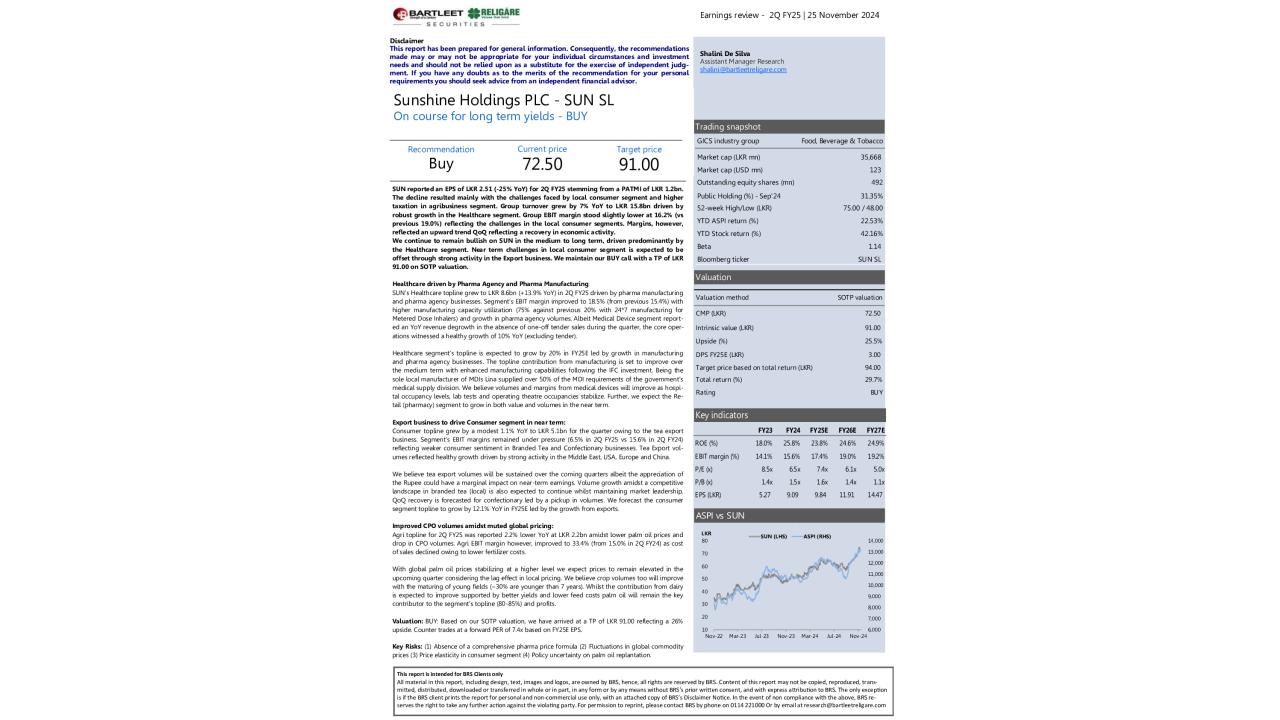

Hemas Holdings PLC (HHL) - 1Q FY26 Earnings Review - BUY

Earnings Reviews

11/09/2025

1k

0

We believe HHL is strongly positioned in the Healthcare space with the growing portfolio of branded generic drugs coupled with niche product mix with higher margins and hospital expansions. Focus on Personal Care, Beauty and wellness and exploration of underpenetrated markets while also exploring international markets will be the key drivers for Consumer Brands. Supported by favourable macro conditions and HHL’s strong market positioning across key verticals, we reiterate our BUY recommendation with a FY26E Target Price of LKR 38.00.

You must login to post a comment.