SUN Earnings Review 2Q FY26 - BRS Equity Research

Earnings Reviews

15/12/2025

382

0

Valuation Fairly Reflects Fundamentals

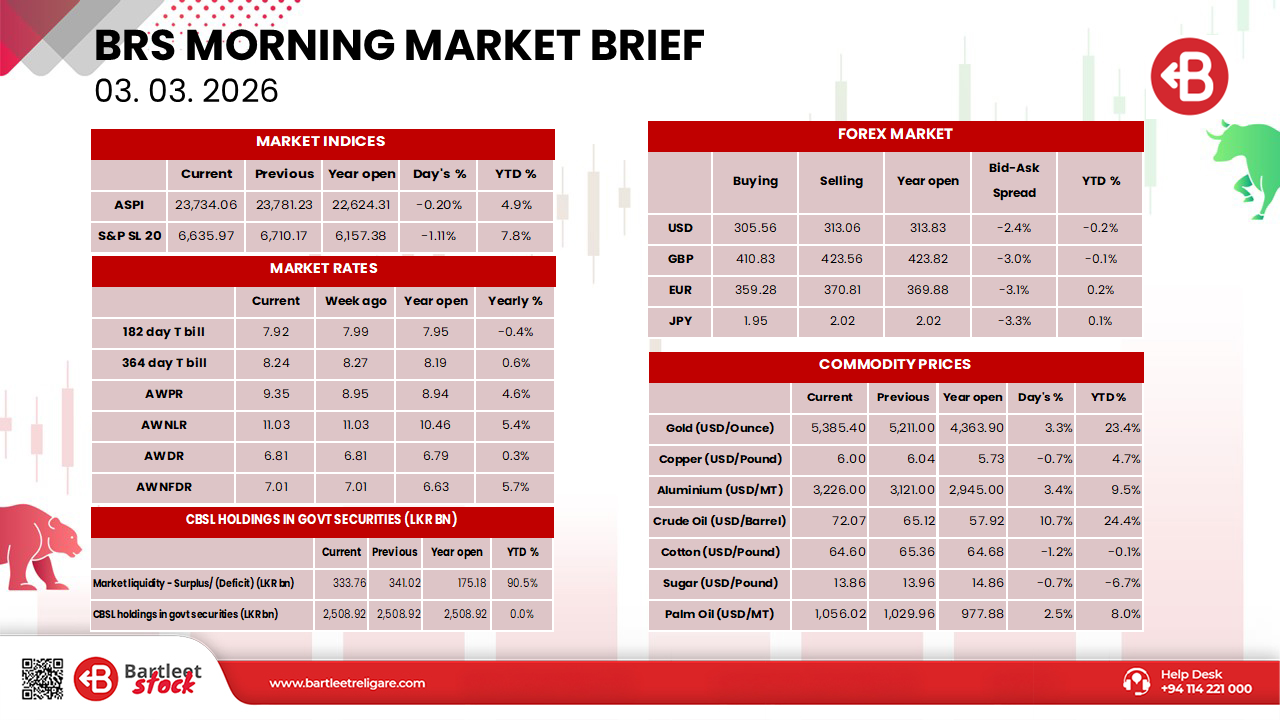

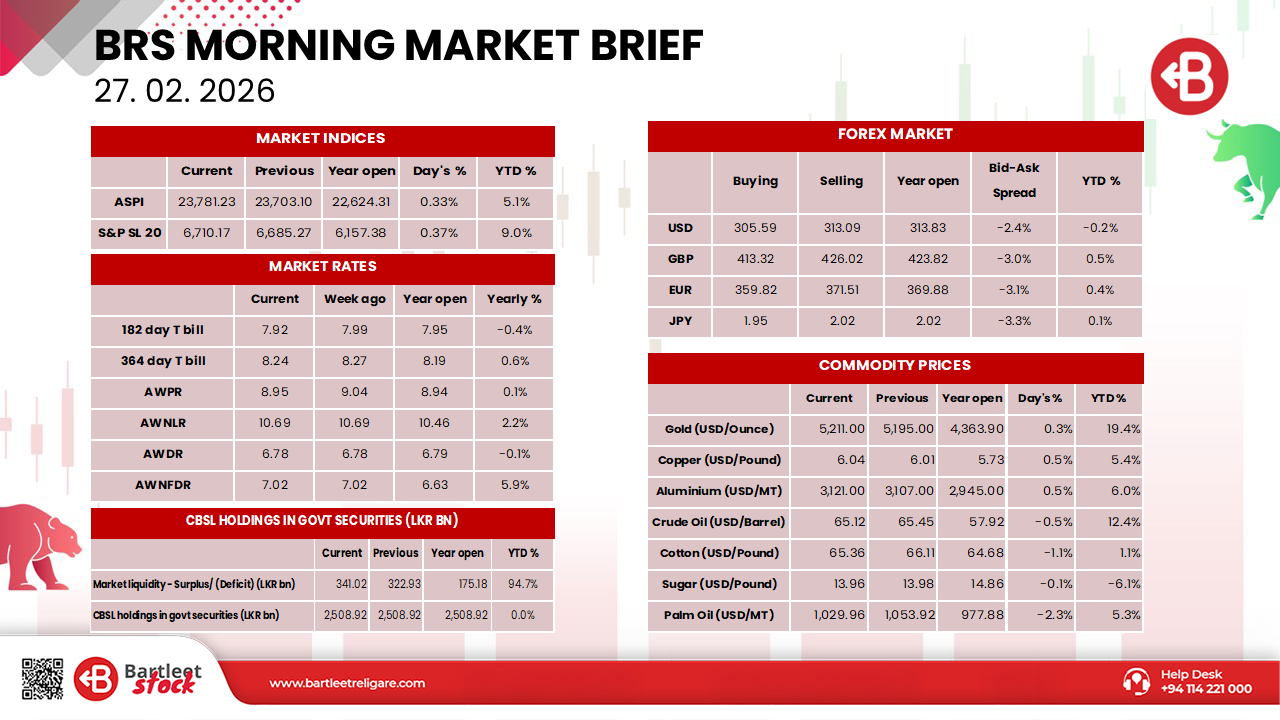

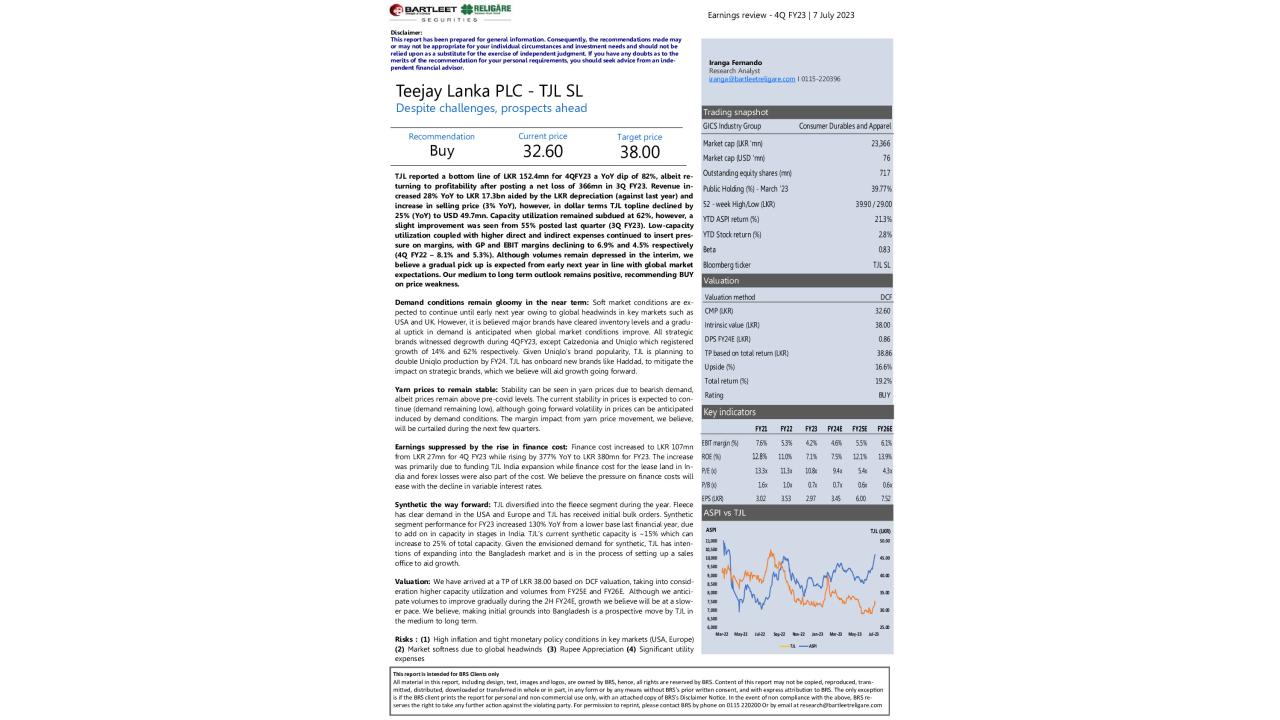

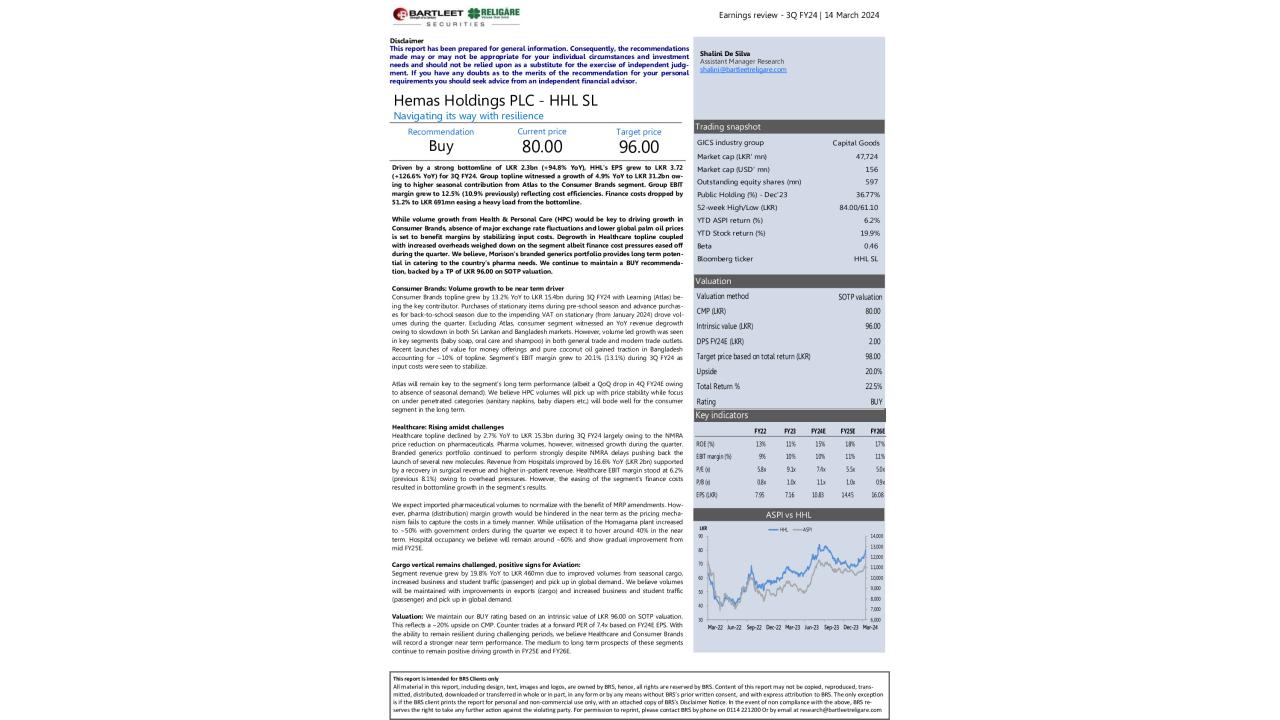

💰 EPS of LKR 0.35 for 2Q FY26 (-43.7% YoY as PATMI (LKR 695mn) was impacted by one-off tax provisions and higher NCI allocation. 📈 Topline sustained by improved palm oil prices in Agri to LKR 16.4bn (+3.7% YoY). 📊 Group EBIT margin rose to 17.4% (vs previous 16.2%) with improvements in Agri and Consumer offsetting the margin contraction in Healthcare.🏥 Volumes improved in the pharma agency, Healthguard retail and medical device businesses during the quarter.💊 Pharma (manufacturing, agency & distribution) to drive Healthcare growth. ☕ Tea volumes (local and export) improved YoY. However, high value tea exports declined following US tariff adjustments. 🍬 Domestic tea business margins to tighten, confectionary volumes will remain challenged.🌴 Strong palm oil prices and improvement in sales volumes drove Agri numbers in 2Q FY26. Global palm oil prices are likely to remain firm resulting in elevated local pricing. 📈 Valuation & recommendation: Target prices revised to LKR 40.00 for FY27E (+12.4% upside on CMP), downgrade to HOLD ⚠ Risks: (1) Regulatory changes (2) Global commodity fluctuations (3) Price elasticity in consumer business (4) Uncertainty on palm oil replantation.

You must login to post a comment.